Mini Money

Building financial confidence for the next generation

Children begin to develop their spending and savings habits by the age of 5

Millennials average $28,000 in debt (most stems from credit cards, not student loans).

74% of people in debt report “debt regret,” which financial education can prevent.

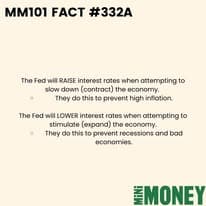

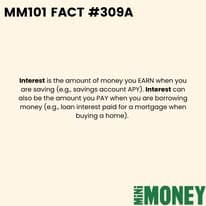

70% of Americans can't answer questions on inflation, interest compounding and risk diversification.

What We Do

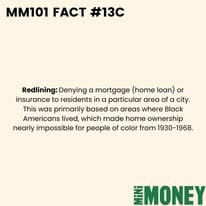

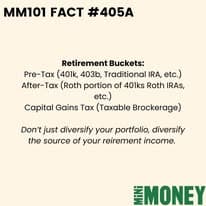

Mini Money teaches the basics principles of money and financial literacy: it's the first step to peace of mind, high quality of life, and finding our passions.

Our Community

Skills Developed

Financial awareness

Responsibility

Critical thinking

Self-motivation

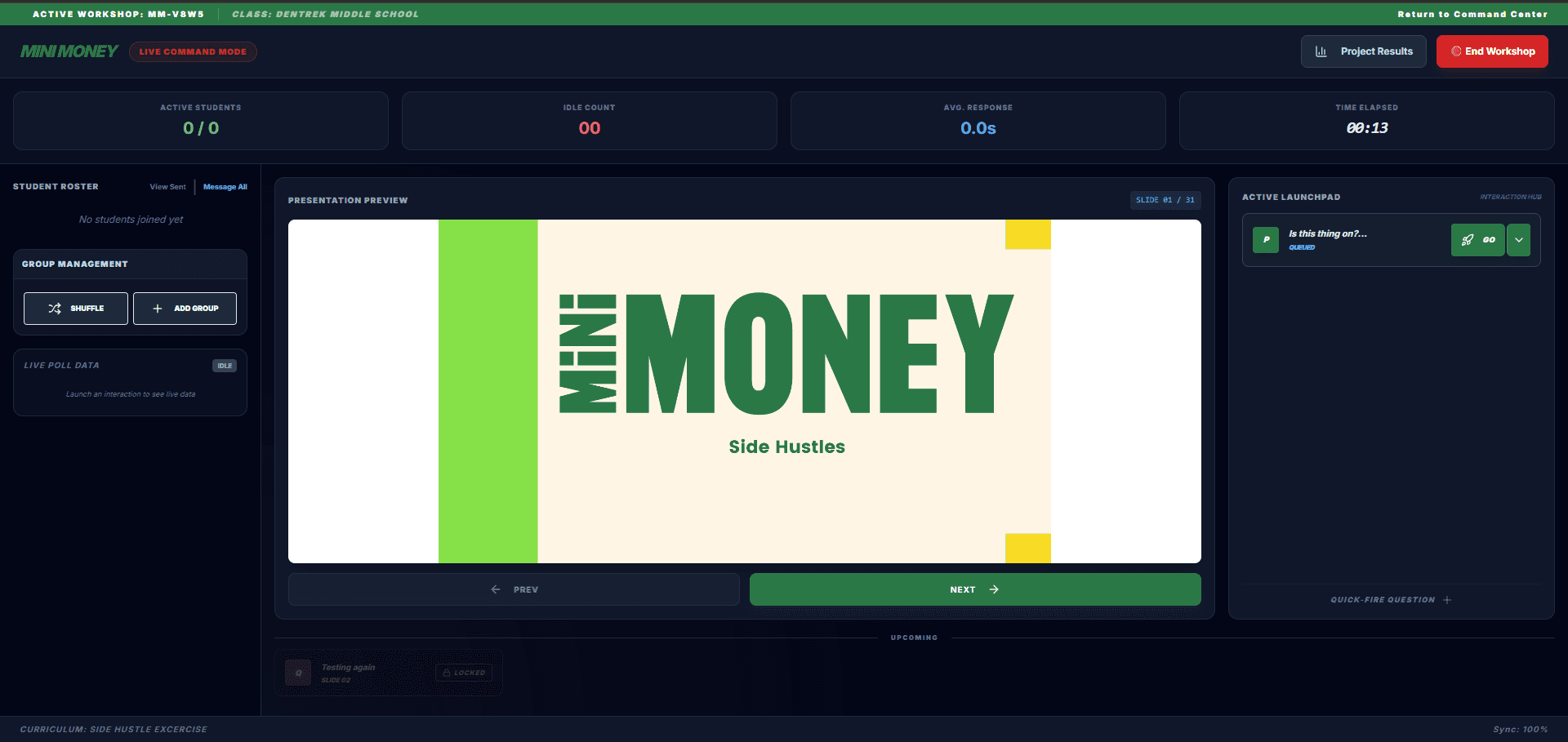

For Teachers

User-friendly tools support classroom management and streamline existing structures.

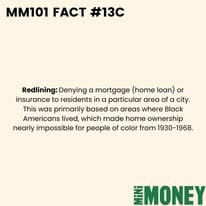

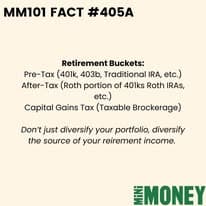

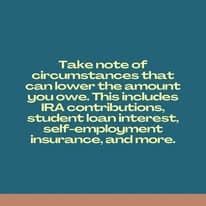

Bite-sized lessons on relevant themes keep students engaged and informed.

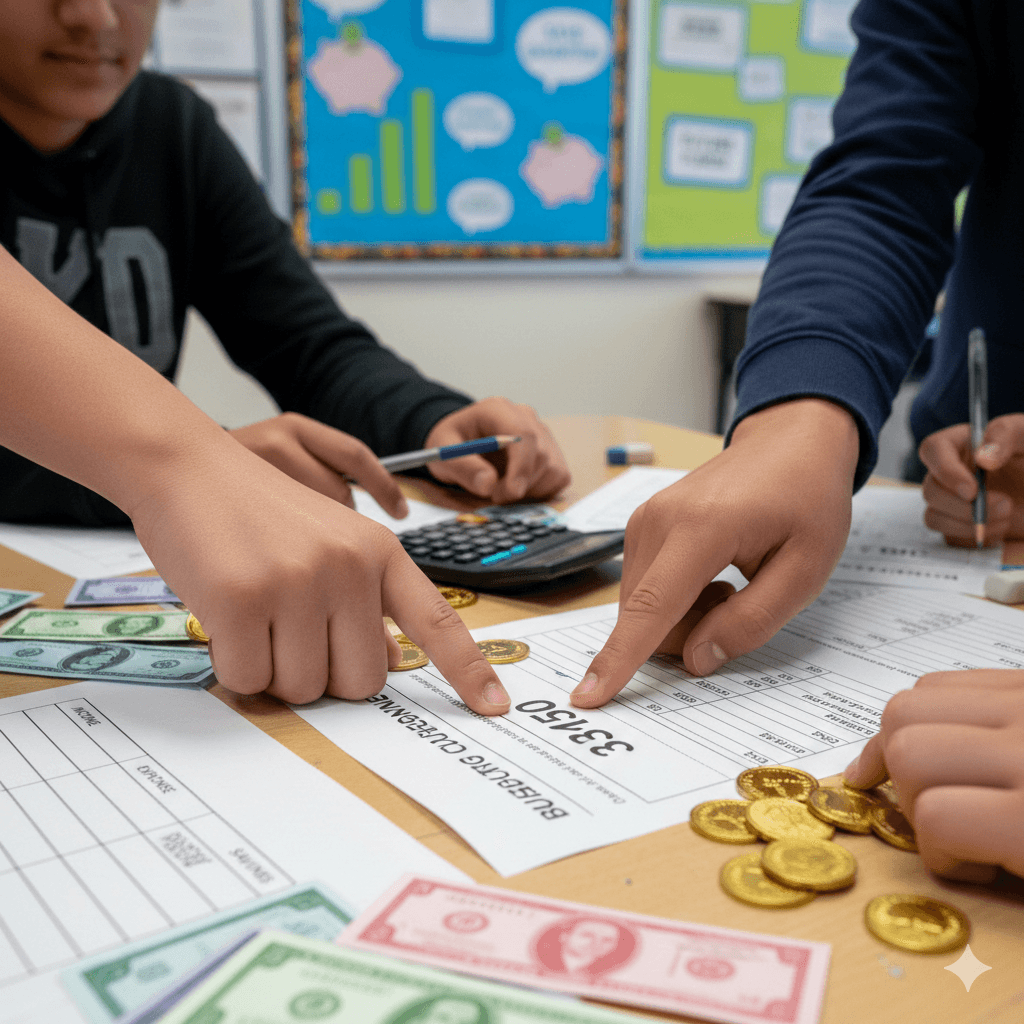

Educational Approach

Financial simulations give students life-like expenses like rent, meals, and fines.

Students learn to prioritize limited resources and understand non-essential desires.

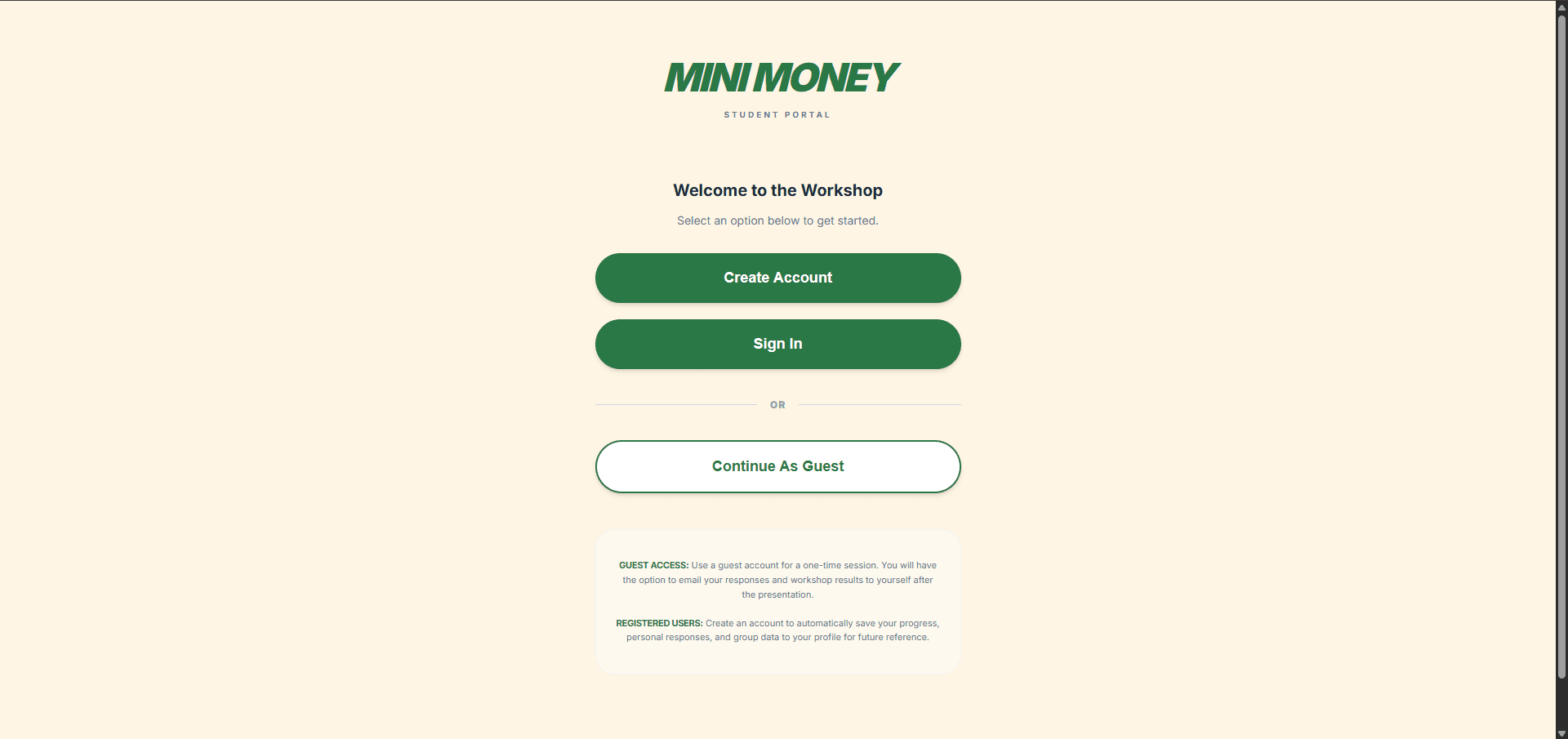

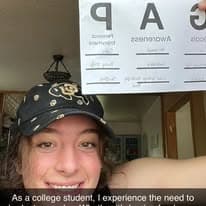

Student Experience

Students practice earning, saving, budgeting, and spending in realistic contexts

Our Impact

4,000+

Students Served

4.7/5

Workshop Rating

Since 2019

Years of Impact

8+

Partner Organizations

Trusted by Leading Organizations

Denver Public Schools

University of Denver

Denver Housing Authority

NC State University

Minds Matter Colorado

GlobalMindED

Boulder Valley School District

Red Rocks Community College

Making an Impact

“I learned how important saving money is. I knew it was somewhat important before, but now I know how much more important it is and how it will benefit you in the long run.”

— Mini Money Student

See Mini Money in Action

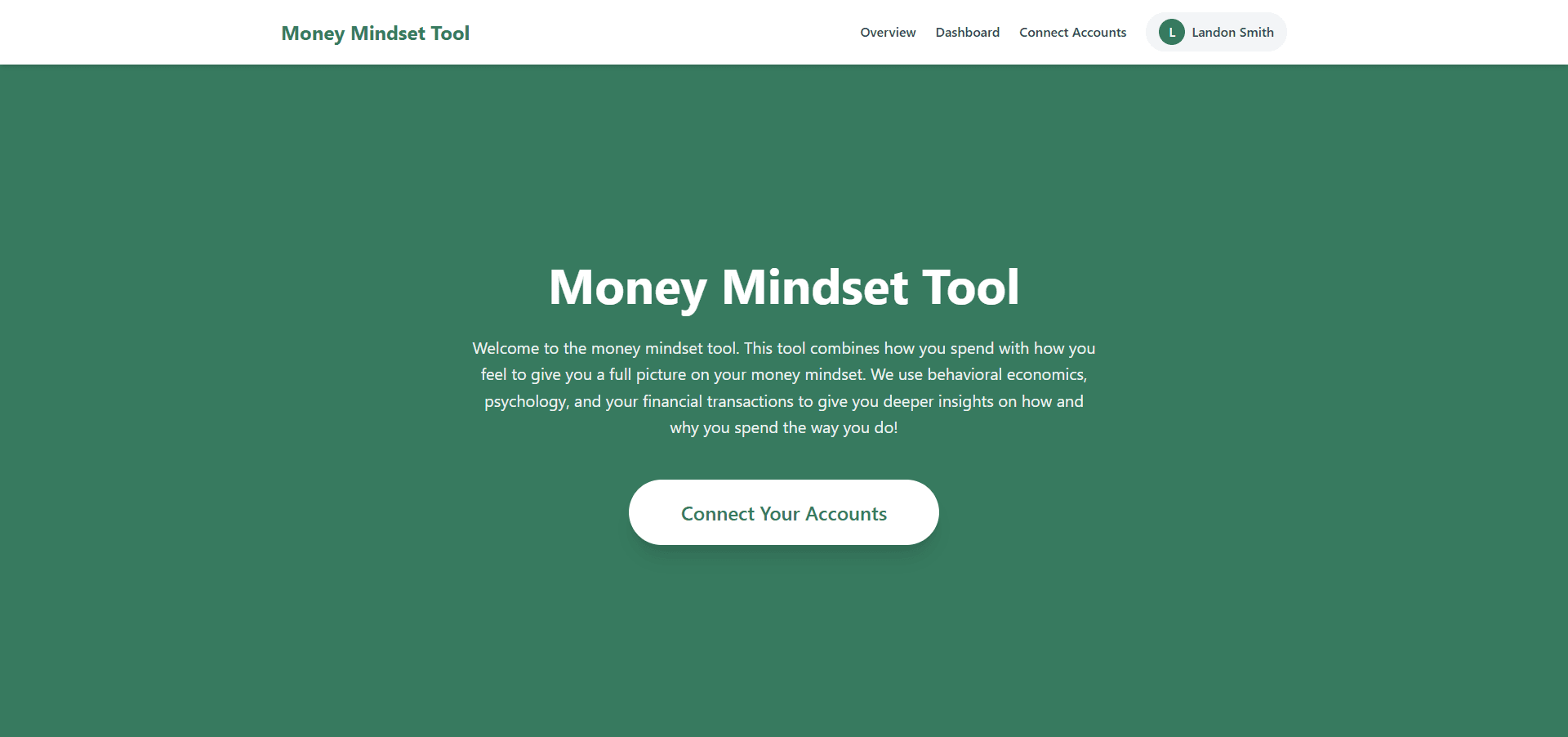

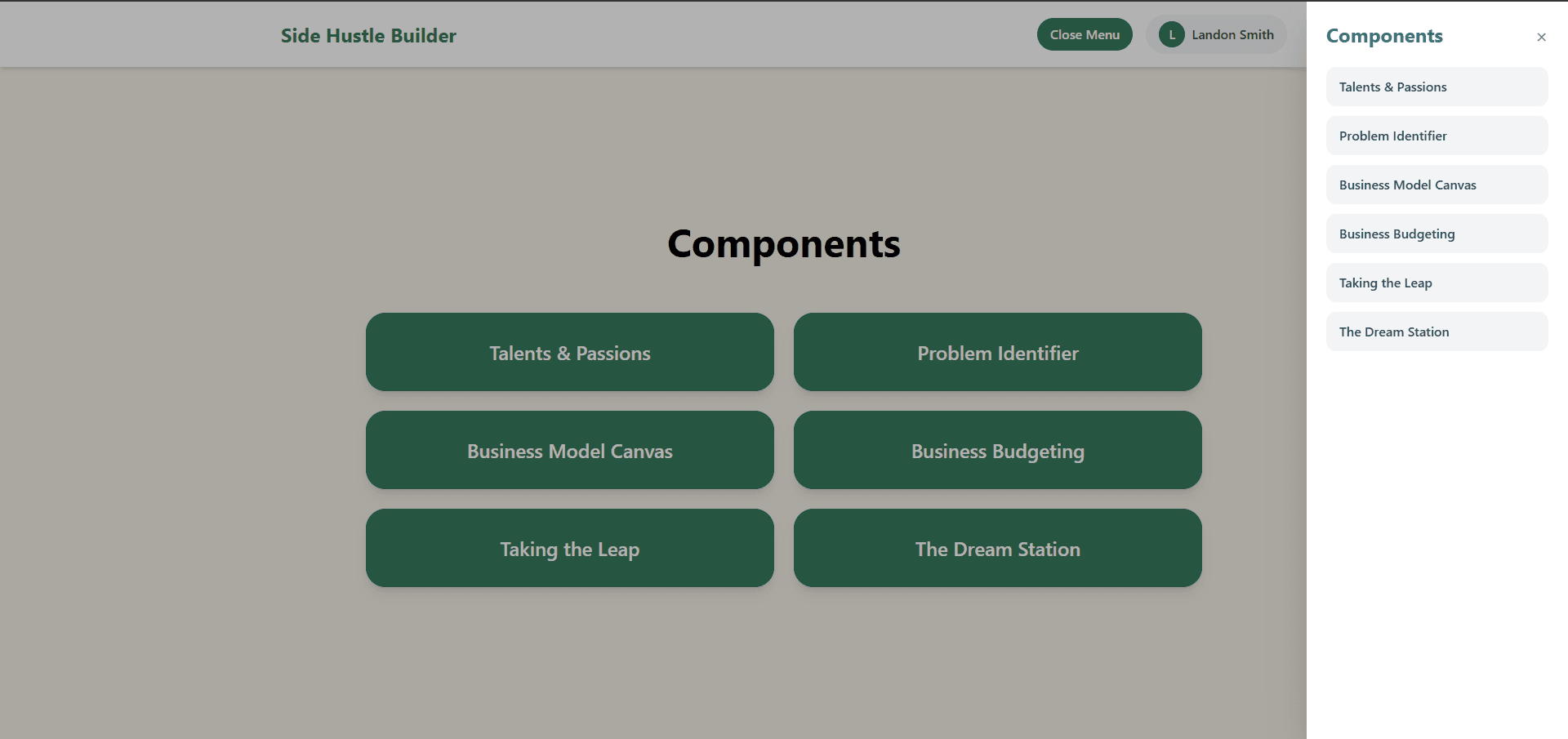

Mini Money Tools

Interactive tools designed to build real-world financial skills